Search Filters

Latest UK HMRC Advisory Fuel Rates December 2023

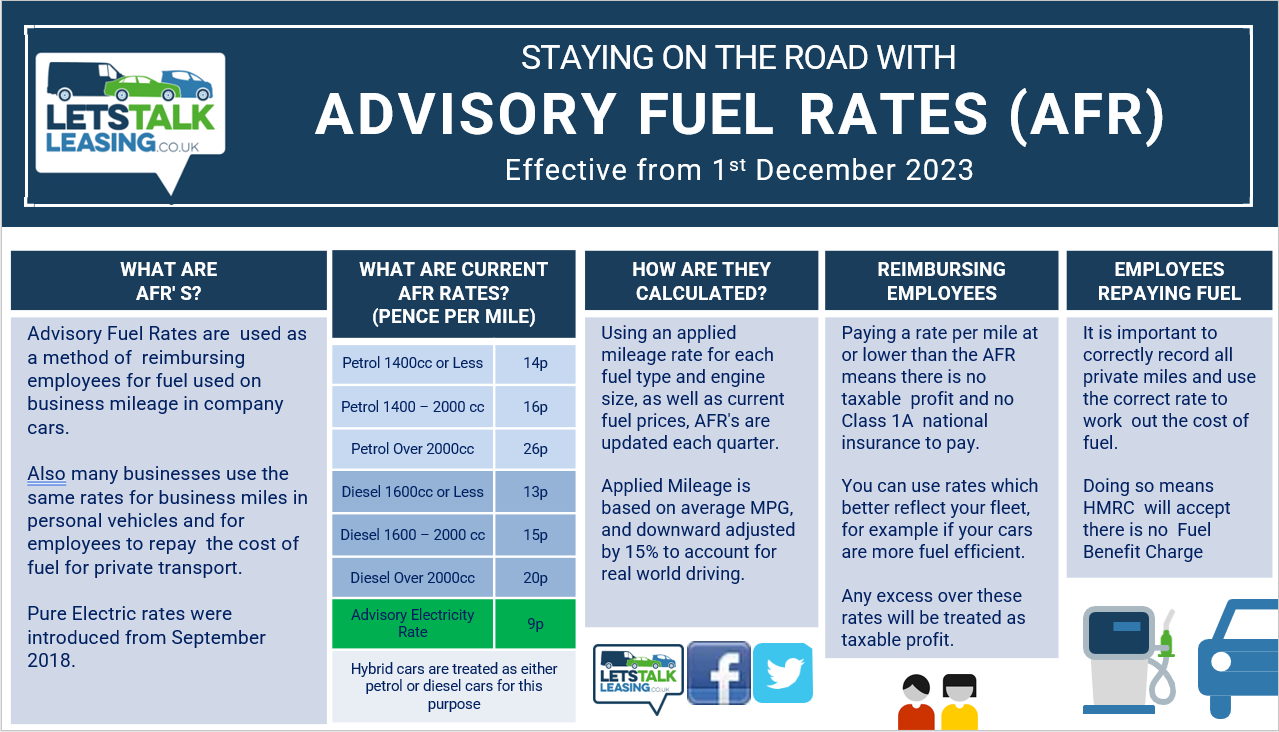

The HM Revenue & Customs (HMRC) in the UK regularly updates the advisory fuel rates. These rates are important for company car users and are used to calculate the reimbursement amount when employees use their company cars for business travel and need to be reimbursed for fuel expenses.

The latest advisory fuel rates were published by HMRC on November 24, 2023 and will be effective from December 1, 2023, there have been some changes in the rates for different types of vehicles.

Petrol

The rates have increased by 1p for engine sizes 1400cc or less and larger sized petrol engines over 2000cc.

Diesel

The rate for diesel vehicles has also increased by 1p for all engines.

These changes are important for both employers and employees. Employers need to ensure that they are using the correct rates when reimbursing employees for fuel expenses related to business travel. Employees, on the other hand, need to be aware of these rates to ensure that they are being properly reimbursed and that they are using the correct rates when claiming expenses.

Personal Use vehicles

It's worth noting that the advisory fuel rates apply only to company cars. For personal vehicles, different rules and rates might apply. Employees using their personal vehicles for business travel should consult with their employers or refer to the appropriate guidelines provided by HMRC as these are covered by AMAP (Approved Mileage Allowance Payments” rules.

Tax Implications

If you are a company car user or an employer responsible for reimbursing fuel expenses, it is crucial to stay updated with the latest advisory fuel rates as they can impact your finances and tax obligations. The rates are subject to change, so it's essential to regularly check for updates from HMRC and when employees are reimbursed in excess of the AFR rates then a tax charge is likely to arise.

To find the official advisory fuel rates published by HMRC, you can visit the GOV.UK website. There you will find detailed information about the rates, how they are calculated, and when they apply. The GOV.UK website also provides other useful resources and guidance related to travel, mileage, and fuel allowances that can help both employers and employees.

Remember, staying informed about the latest advisory fuel rates is important for accurate reimbursement and compliance with tax regulations. Make sure to check the official sources regularly for any updates or changes to the rates.

I hope this helps! Let us know if you have any further questions.

Want to find out more?

LetsTalk Leasing is an independent online leasing company offering customers the very best prices on new vehicle leases. When you lease a car with us, we will make the process as simple as possible by being transparent with our fees and providing a straightforward service and can help answer any questions you may have around business leasing and company cars.

For more information about our services, contact our team of friendly advisors by calling us on 0330 056 3331 or emailing [email protected]

Vehicle Showroom

You need to have an account to add vehicles to your showroom. Click the button below to login or to create a new account.

Register or Log In