Search Filters

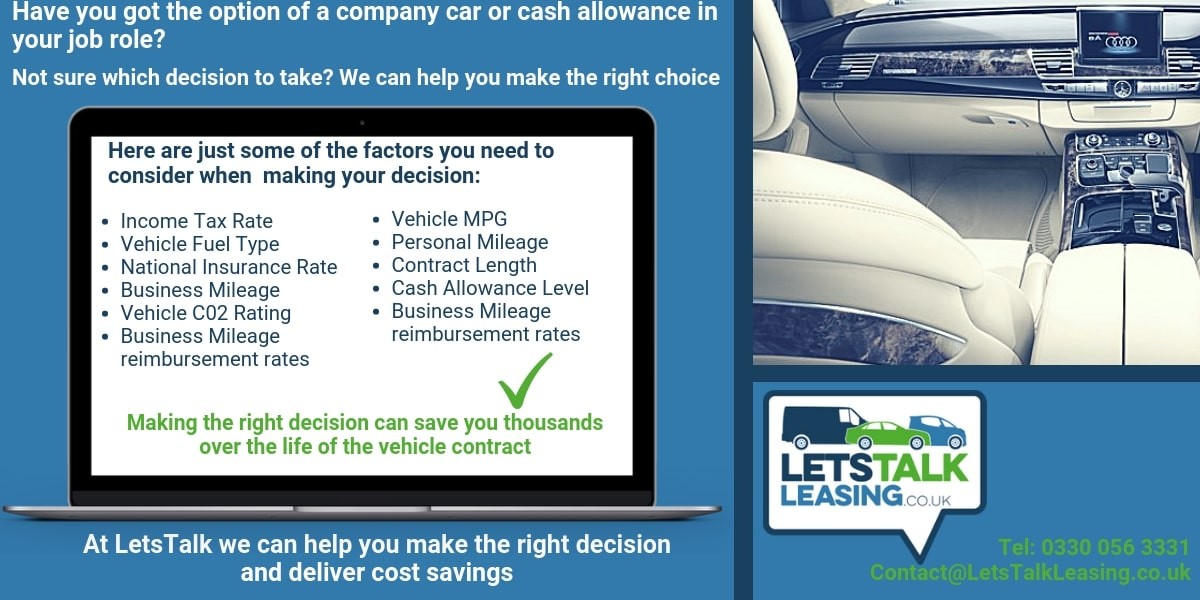

Should you take a Company Car or Cash Allowance?

Many businesses offer car allowances either alongside or instead of a company car and given the significant increases in company car tax over the last few years more and more employees are exercising their option and cashing out, whilst this trend has grown over recent years it is always worth checking before you make the decision particularly as there are new lower benefit in kind tax rates coming for Electric cars.

In addition Personal Car Leasing is a growing part of the new car finance market taking share from Personal Contract Purchase each year as more and more drivers are becoming aware of the cheap car leasing deals offered by businesses like LetsTalk Leasing, our Fleet Consultancy Experts have summarised the factors both businesses and employees need to consider when making their company car or car allowance decision.

Business Perspective

When setting cash allowances businesses need to decide what their strategy is and with the strategy clearly set should consider the following when developing your cash alternative:

Cash Allowance Level

- Encourage company car take up - Many businesses want to keep drivers in company cars and will set cash allowances accordingly especially when considered in line with Corporate & Social Responsibility

- Encourage cash take up - Increasingly popular solution given the rise in company car benefit in kind tax, companies need to ensure they still have awareness of the vehicles being driven on company business

- Remaining cost neutral irrespective of the employee's decision - This effectively locks down the company's costs but still gives the employees choice

- Mileage reimbursement decision - See below - The method chosen to reimburse business mileage will impact the level of allowance you should set

Mileage Reimbursement

- Use Approved Mileage Allowance Payments (AMAP) - These tax free payments are used to reimburse business mileage undertaken in an employee's own car and are 45p per mile for the first 10,000 miles in a tax year and 25p per mile for each mile over 10,000, whilst the tax free status is attractive it can encourage unnecessary business miles

- Use advisory fuel rates - These rates change regularly but are based on covering the cost of the fuel used and vary by fuel type and engine size, electric vehicle rates are now included at 4p per mile

- Actual cost of fuel via fuel card - Use a fuel car to cover business miles

- Private mileage taxation - Few company's offer this now due to the high tax burden on the employee as break even private mileage can be over 15,000 miles per year

Vehicle Type & Usage

- Vehicle funding options - Business car lease or buy decision for the company

- Do employees need specific vehicles to undertake their role? - Could an employee source a suitable vehicle personally via their leasing options

- Business miles undertaken - The higher the business mileage the higher the cost, more scope for tax free AMAP payments but the employee's personal vehicle costs will be higher

- Personal mileage - This impacts the total cost of the company car

- Vehicle cost - This impacts lease rate and tax costs

- Vehicle Fuel Type - This impacts fuel and tax costs

- Vehicle C02 rating - This impacts tax costs

- Vehicle Miles Per Gallon (MPG) performance - Can be important depending on business mileage reimbursement rates used, consider Hybrid Car Leasing or Electric vehicle leasing to reduce fuel spend depending on your business requirements

- Contract Length - How long are the vehicles kept for impacts total costs

Taxation

- Corporation Tax - Rate impacts total business costs

- VAT - 50% of Vat on capital element of the business car lease is recoverable for many businesses

- Income Tax - Drivers income tax position influences their net spending power and company car tax

- Employers National Insurance - Payable by the company on the company car benefit and on any cash allowance

Risk Management

- Company Car - This gives the company visibility and control of the vehicle being used to ensure its fit for purpose, maintained and repaired

- Cash Allowance - The company loses visibility of the actual car used but still has an obligation to ensure any vehicle used for business mileage is fit for purpose and needs to be aware of potential impact on business reputation

- Driving licence - Companies should check employee's licences for endorsements irrespective of whether the employee chooses cash or car

Employee Perspective

You need to decide if you want a car equivalent to the company car or something less/more expensive, having cash gives you more choice but you should consider all of the following before you make a decision:

Cash Allowance Level & Mileage Reimbursement

- This will be set for you by the company its likely to be taxable but not pensionable earnings

- Business mileage reimbursement may be at cost or via AMAP payments

- Your net spend after tax will need to cover sourcing a vehicle, insuring, maintaining and repairing

- Sourcing options include cheap car leasing options where you can source cheap car lease deals and you can use our car lease comparison tools to find your perfect vehicle Help Me Choose My Perfect Car

Vehicle Type & Usage

- The vehicle you source personally needs to be compliant with your company policy and fit for business purposes

- Business miles undertaken - Whilst the cost of fuel will be paid by the company these extra miles will increase the cost of your personal vehicle

- Alternative fuelled cars such as Electric cars are potentially favourable from a tax perspective however care should be taken to ensure he vehicle is suitable for business and personal use purposes

Taxation

- Company Car Tax - Use a company car tax calculator to ensure you are basing your decision on the right costs given the complexity

- Income Tax - Your company car benefit in kind and cash allowance are subject to income tax

- Employees National Insurance - You pay this on your cash allowance but not on a company car benefit in kind

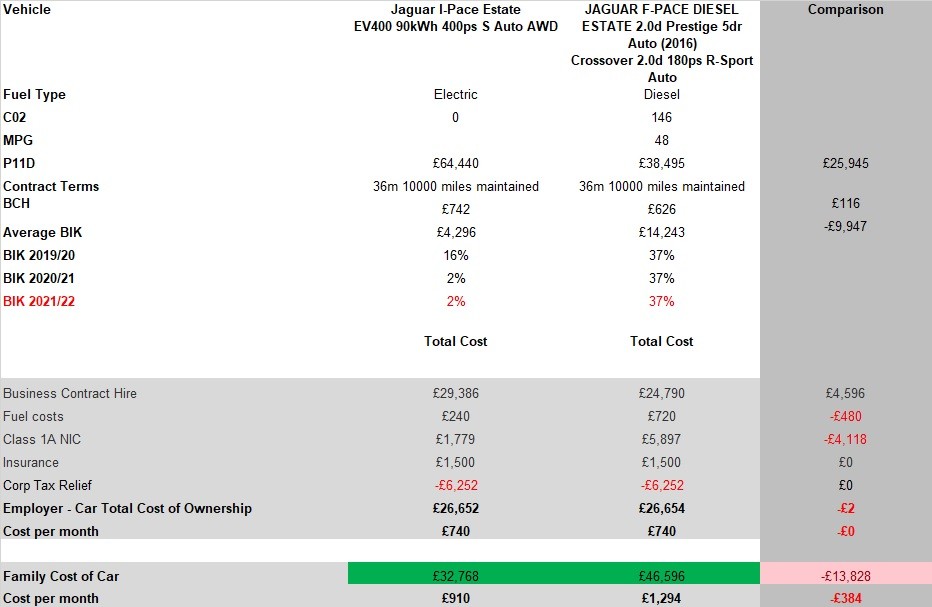

Financially Modelling the Company Car or Cash Allowance Decision

Given the list of inputs above it can be complex to model the total impact on both the company and the employee, our model takes all factors into consideration including the available of cheap car leasing alternatives

Our model is flexible and can deal with any individuals scenario and can be flexxed to understand the potential impact of any future changes to the individuals circumstances.

Summing Up

With the numbers involved being typically ~£7,500 per employee per year the right decision is crucial to both the company and the employee, however this number changes on a regular basis with Benefit in Kind Tax changes, Contract Hire and Leasing deal pricing and cost of fuel some of the big drivers, our team of Fleet Consultancy team can quickly model the answer based on your individual requirements whether you are the employer or the employee, if you would like us to take a look at your decision, Lets Talk!

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 75ps Design

From

£210.35 per mth exc. VAT

Initial rental: £1,893.15 exc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 75ps GS

From

£215.62 per mth exc. VAT

Initial rental: £1,940.58 exc. VAT

Hyundai i30 Hatchback

5 Door Hatch 1.0 T-GDi 120ps SE Connect

From

£227.28 per mth exc. VAT

Initial rental: £2,045.52 exc. VAT

Hyundai i30 Hatchback

5 Door Hatch 1.0 T-GDi 120ps SE Connect DCT

From

£237.39 per mth exc. VAT

Initial rental: £2,136.51 exc. VAT

Ford Puma Hatchback

1.0 EcoBoost Hybrid mHEV 155 Titanium DCT

From

£243.09 per mth exc. VAT

Initial rental: £2,187.81 exc. VAT

Hyundai i30 Hatchback

5 Door Hatch 1.0 T-GDi 120ps Premium

From

£243.26 per mth exc. VAT

Initial rental: £2,189.34 exc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 Turbo 130ps GS Auto

From

£243.51 per mth exc. VAT

Initial rental: £2,191.59 exc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 Turbo 130 Ultimate Auto

From

£244.59 per mth exc. VAT

Initial rental: £2,201.31 exc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 75ps Design

From

£252.42 per mth inc. VAT

Initial rental: £2,271.78 inc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 75ps GS

From

£258.74 per mth inc. VAT

Initial rental: £2,328.70 inc. VAT

Hyundai i30 Hatchback

5 Door Hatch 1.0 T-GDi 120ps SE Connect

From

£272.74 per mth inc. VAT

Initial rental: £2,454.62 inc. VAT

Hyundai i30 Hatchback

5 Door Hatch 1.0 T-GDi 120ps SE Connect DCT

From

£284.87 per mth inc. VAT

Initial rental: £2,563.81 inc. VAT

Ford Puma Hatchback

1.0 EcoBoost Hybrid mHEV 155 Titanium DCT

From

£291.71 per mth inc. VAT

Initial rental: £2,625.37 inc. VAT

Hyundai i30 Hatchback

5 Door Hatch 1.0 T-GDi 120ps Premium

From

£291.91 per mth inc. VAT

Initial rental: £2,627.21 inc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 Turbo 130ps GS Auto

From

£292.21 per mth inc. VAT

Initial rental: £2,629.91 inc. VAT

Vauxhall Corsa Hatchback

5 Door Hatch 1.2 Turbo 130 Ultimate Auto

From

£293.51 per mth inc. VAT

Initial rental: £2,641.57 inc. VAT

Vehicle Showroom

You need to have an account to add vehicles to your showroom. Click the button below to login or to create a new account.

Register or Log In