Will Hybrid Car Leasing options will reduce company car driver's benefit in kind tax in 2020?

Company car benefit in kind rates have increased significantly in recent years for Petrol and Diesel cars however that’s not the case for Hybrid and Electric Cars.

The low rates (As little as £169+vat...) for some Hybrid cars can result in some significant variations between similar vehicles as we discussed previously (A Tale of 2 SUVs) .

To understand whether company car rates will drop its important to understand what the alternative fuelled options are:

Electric Vehicle Leasing

Whilst 2019 was a busy year for Electric vehicle launches (Battery Electric Vehicles) take up is still low at around 1.5% of all vehicles registered. Data from Society of Motor Manufacturers and Traders (SMMT) .

This is due to :

1) Vehicle acquisition cost is still high

2) Electric driving range isnt sufficient for all drivers

3) Range anxiety and charging infrastructure concerns

4) Supply of vehicles is still low and lead times are often long

There is no doubt this number is increasing and 2020 will see significant growth but many of the issues noted above will still apply, maybe 2020 will be the year of the Electric vehicle for business car leasing?

Electric cars will usually result in the lowest benefit in kind charges as their C02 emissions are zero but may not be the best option due to the above.

Hybrid Vehicle Leasing

There is another option though and this is where Hybrid vehicles come in, they allow some Electric Driving which enables drivers to take advantage of Electric Vehicle Driving benefits (reduced emisisons and lower benefit in kind costs) without the raneg anxiety and vehicle supply issues.

Hybrid vehicles represented 5.7% of all vehicles registered to November 2019, this is Plug in Hybrid and Hybrid only not Mild Hybrids which use Electric power to boost engine efficiency but do not have an Electric only driving mode. If you need more information on Electric and Hybrid vehicles take a look at our guide : Electric & Hybrid Vehicle Leasing Guide

A Plug-In Hybrid Vehicle (PHEV) is a vehicle that can be powered by either a battery or a more standard fuel based internal combustion engine (ICE). The driving range will typically be a lot lower for the battery fuelled option when compared to the range of the ICE powered by diesel or unleaded fuel, with battery range typically being 12-50 miles, this range is growing. The driver is able to switch between battery power and ICE at their convenience.

As these vehicles can be ran in Electric only mode this means they often have lower C02 emissions than their Combustion counterparts.

This will impact the driver and the businesses operating Fleets through lower Benefit in Kind tax and associated Class 1A National Insurance payable by the company.

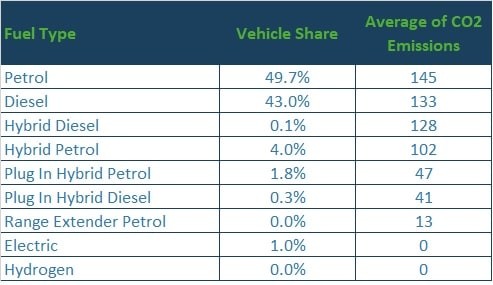

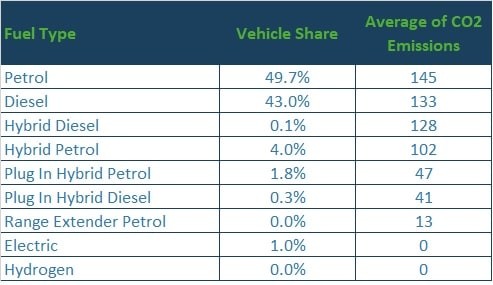

Which we can see below, at the time of writing we have over 10,000 cars available to lease, average C02 emissions for PHEV is 44 versus 138 for combustion engines.

Company Car Tax Impact

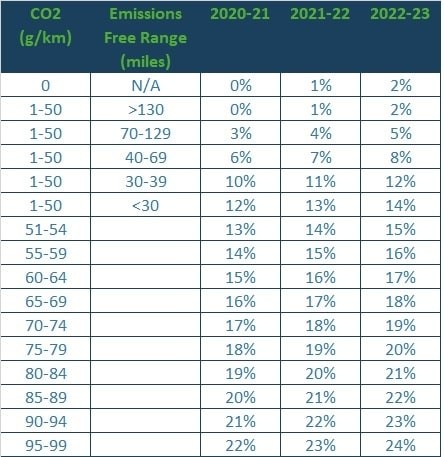

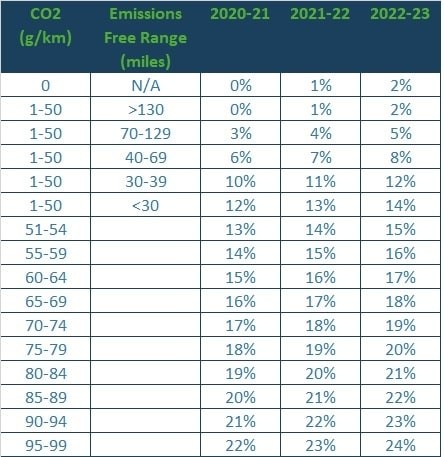

As any savvy company car driver knows this can have a huge impact on Company Car Driver Benefit in Kind Tax (BIK), from April 2020 Hybrid vehicles with under 50 g C02 emissions can attract a BIK tax rate from 0%-12%, this compares to a Petrol vehicle which is often over 100g C02 (BIK 23%+) or Diesel which will attract a 4% supplement (unless RDE 2 compliant)

BMW X5 Example

So how does this work out for the company car driver?

BMW X5 SUV 5 Door xDrive30d M Sport - Diesel - P11d Value £60,230. C02 162, 37% BIK %Age would mean £743 BIK tax per month for a 40% taxpayer.

BMW X5 SUV 5 Door xDrive45e M Sport - Hybrid - P11d Value £66,610. C02 41, 8% BIK %Age would mean £178 BIK tax per month for a 40% taxpayer

A huge £568 a month saving in Benefit in Kind tax versus the Diesel variant!

One key point is the vehicles Emissions Free Range (Electric only range), for cars with C02 under 50g this dictates which tax bracket they fall into, surprisingly information is still quite scant on these figures so please check before ordering.

Hybrid Car Leasing Options

There are currently more than 270 Hybrid Vehicle options available to lease and this number is increasing every week with alternatives coming in alternative shapes and sizes, below we summarise some options from each vehicle category.

-min.jpg)

-min.jpg)